Bhim App UPI Payment

Bhim App By Modi: How To Use It For UPI Payments

Presenting an app which is Launched by PM Modi. By Which you can Transact or Pay to merchant cashless by UPI or VPA. So, In this article I am going Mention all the Benefit and Full Use of Bhim App by PM Modi.

About Bhim App:

Bharat Interface for Money (BHIM) is an initiative to enable fast, secure, reliable cashless payments through your mobile phone. BHIM is interoperable with other Unified Payment Interface (UPI) applications, and bank accounts. BHIM is developed by the National Payment Corporation of India (NPCI). BHIM is made in India and dedicated to the service of the nation.

Steps To Use Bhim App For UPI Payment:

- Download Bhim (Bharat Interface for Money) App From Playstore – Click Here

- Install and open it

- Skip Intro’s and Set Pin for the app

- It will Verify Mobile no. automatically (Make sure that your Mobile no. is Registered with Bank account)

- Now Select Bank Name (It will auto detect your Bank if your Mobile no. is Registered with any Bank account)

- Enter card details to Verify your account

- Now you will be either asked to choose UPI PIN or if you already have one UPI VPA then process will end

Steps To Send Money From Bhim App:

The user can send or receive money from friends, family and customers through a mobile number (payment address). The money can also be sent to non-UPI supported banks. This can be done using MMID and IFSC. The user can also collect money by sending a request and reverse payments if required.

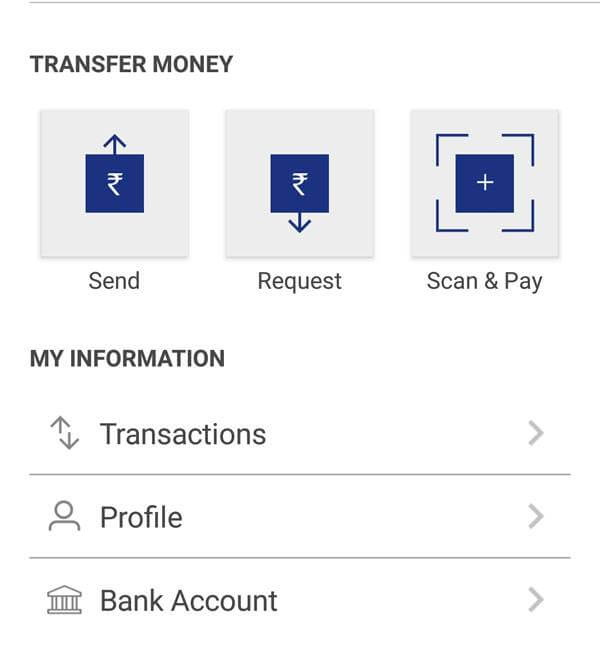

If Send, Request & Scan & Pay option is showing then you are Registered

- Click Send Money Option

- Enter or select the receiver’s mobile number or Payment Address (you can select from your contact list or enter it) or Aadhaar number

- Enter the amount you want to send

- Your default bank a/c gets selected

- Enter UPI PIN and send. Alternately, you can also scan a QR code and pay via the ‘Scan & Pay’ option.

Steps To Request Money From Bhim App:

- Select Request Money

- Enter or select the receiver’s mobile number or Payment Address (you can select from your contact list or enter it) or Adhaar number

- Enter the amount you want to request

- Click Send.

How To Send Money Who Is Not On Bhim App:

Yes. Payment can be made via (IFSC, Account number) or (MMID, Mobile number) if the person is not registered on Bharat Interface for Money.

FAQs (Frequently Asked Questions)

1. How fast is a transaction over Bharat Interface for Money?

As fast as it can get! All payments over Bharat Interface for Money are linked to your bank account and transaction can be completed within few seconds.

2. Are there any charges for using Bharat Interface for Money?

There are no charges for making transaction through Bharat Interface for Money. Note – Your bank might however levy a nominal charge as UPI or IMPS transfer fee which is not under our control. Please check with your bank for more details.

3. What do I need to start using Bharat Interface for Money?

Bharat Interface for Money app is currently available on Android (Version 8 and above) and iOS mobiles (Version 5 and above). We will be making our app available on other platforms very soon.

4. Is Bharat Interface for Money app compatible with every Mobile OS?

To start using Bharat Interface for Money all you need is a Smartphone, Internet access, an Indian bank account that supports UPI payments and mobile number linked to the bank account. Link your bank account to UPI through the app.

5. Do I need to enable mobile banking on my bank account to use Bharat Interface for Money?

Your account need not be enabled for mobile banking to use Bharat Interface for Money. Your mobile number shall have to be registered with the Bank.

6. Do I need to be a customer of a particular bank to use Bharat Interface for Money?

To enable transfers directly using your bank account, your bank needs to be live on UPI (Unified Payment Interface) platform. All the banks, which are currently live on UPI, have been listed in the Bharat Interface for Money app.

7. How do I set the UPI-PIN for my bank account from Bharat Interface for Money?

You can set your UPI PIN by going to Main Menu -Bank Accounts -Set UPI-PIN for the selected account. You will be prompted to enter the last 6 digits of your Debit/ATM card along with the expiry date. You will then receive an OTP which you will enter and set your UPI PIN. Note – ‘UPI-PIN is not the same as MPIN provided by your bank for mobile banking’.

8. Can I link multiple bank accounts with Bharat Interface for Money?

Currently, Bharat Interface for Money supports linking of one Bank only. At the time of account set-up, you can link your preferred bank account as the default account. In case you want to link another bank account, you can go to Main menu, choose Bank Accounts and select your default account. Any money that is transferred to you using your mobile number or payment address will be credited into your default account.

9. Why does my mobile number with Bharat Interface for Money and the one registered with my bank account have to be the same?

This is a banking network (UPI) requirement. The mobile number which is used to register with Bharat Interface for Money is used to match the bank accounts linked against it.

10. Do I have to give Bharat Interface for Money my bank a/c details?

At the time of registration you will be providing us with the Debit card details and with the use your mobile number registered to your bank account, we will pre-fetch the details from your bank. All the information exchange happens over secure banking networks and we don’t store it, your information is safe!

11. All you need to know about UPI

Unified Payment Interface(UPI) is an instant payment system developed by the National Payments Corporation of India (NPCI), an RBI regulated entity. UPI is built over the IMPS infrastructure and allows you to instantly transfer money between any two parties bank accounts.

12. What happens if I enter wrong UPI-PIN during a transaction?

No problem, the app will prompt you to re-enter the correct UPI-PIN. The maximum number of tries allowed, depends on your bank. Please check with your bank for details.

13. I have selected the Bank name to link with UPI but it does not find my bank a/c

In such a case, please ensure that the mobile number linked to your bank account is same as the one verified in Bharat Interface for Money App. If it is not the same, your bank accounts will not be fetched by the UPI platform. Also only Savings and Current bank accounts are supported by Bharat Interface for Money.

14. Why is my UPI transaction failing?

When you shop-online, you can pay through UPI when you see UPI as a payment option. On clicking that, you will need to enter your Payment Address (xyz@upi). Once entered, you will receive a collect request on your Bharat Interface for Money app. Enter your UPI-PIN here and your payment will be complete. As easy as this!

15. Do I need to be a customer of a particular bank to use Bharat Interface for Money?

To enable transfers directly using your bank account, your bank needs to be live on UPI (Unified Payment Interface) platform. All the banks, which are currently live on UPI, have been listed in the Bharat Interface for Money app.

How to Use Bhim App